Two plaintiffs, Kenneth Donovan and Hussien Kassfy, are suing Coinbase, the San Francisco-based cryptocurrency exchange, for millions of dollars suffered when it suspended the trading of a stablecoin, GYEN, in November 2021 following a de-peg, according to recent reports.

Coinbase and GYEN

In a court filing, the two are accusing Coinbase of promoting and facilitating the trading of GYEN, a stablecoin tracking the price of the Japanese Yen, while also not fully divulging details about the coin’s stability.

A stablecoin is a token minted on a smart contracting platform that ideally tracks the price of a “stable” fiat currency. While most stablecoins are pegged to the USD, Euro, and GBP, others are designed to track the Yen and exotic currencies. The Yen is also considered a safe haven during periods of economic turmoil. Depending on the issuer, a stablecoin can be backed by liquid assets, most of the equal value in fiat currencies, for every coin in circulation.

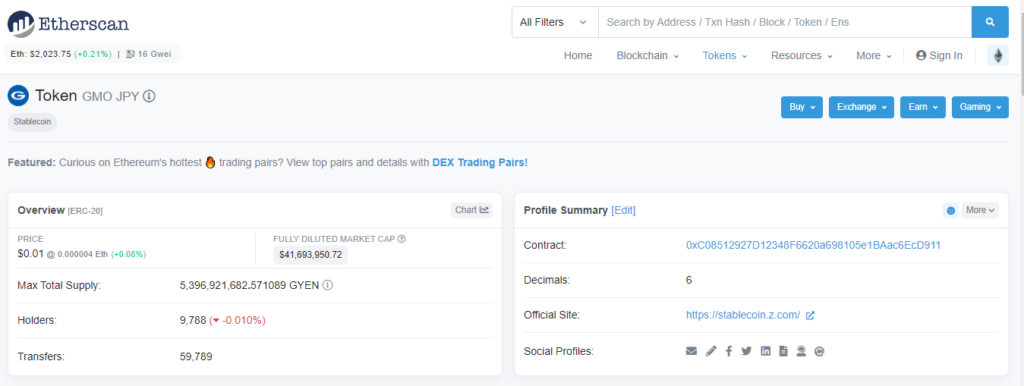

The GYEN was pegged to the Yen and issued by an entity called GMO-Z Trust as a fungible ERC-20 token on Ethereum.

Although the issuer asserted that the GYEN was pegged to the spot value of the Yen and reliable, it only took a few weeks before the stablecoin began stabilizing. For a brief period in mid-November, GYEN drastically rose before tanking by 80 percent in a single day, de-pegging with the Yen and causing massive losses.

Coinbase Halted Trading of GYEN when it De-pegged

However, what compounded losses for GYEN holders, the plaintiffs say, was Coinbase halting the trading of the stablecoin, citing technical reasons and unusual market conditions. Coupled with the exchange’s earlier promotion and facilitating the token’s trading, victims, including the two plaintiffs, want compensation for losses incurred.

A part of the court filing read:

Investors placed orders believing the coin’s value was, as advertised, equal to the Yen, but the tokens they were purchasing were worth up to seven times more than the Yen. Just as suddenly, the GYEN’s value plunged back to the peg, falling 80 percent in one day.

Adding,

As the GYEN’s value was cratering back to the yen, Coinbase compounded the harm by restricting many customers’ ability to sell the asset, then abruptly suspended all trading of the asset without explanation.

As BlockMagnates earlier reported, the cryptocurrency market fell into the doldrums when another algorithmic stablecoin, UST, de-pegged. Leading assets, including Bitcoin and Ethereum, are still reeling from the slide and trading at near 50 percent from Q4 2021 peaks.

Image Source

- ethereum feature image blockmagnates (1): Photo by Nenad Novaković on Unsplash