Most Americans believe that Bitcoin mining is neutral and good for the environment. This finding is when most investors are adopting progressive, environmentally friendly strategies, limiting exposure to assets that may harm the environment.

Not surprisingly, because of Bitcoin’s energy demands, the digital asset is considered a “dirty” asset that’s unwinding progress made by governments and NGOs in making the world green.

Contents

Is There An Interpretation Problem In Reading Bitcoin Mining Energy Demands Data?

This survey goes against the hard stance held by anti Bitcoin and cryptocurrency mining campaigners, including scientists. Their assertions maintain that Bitcoin mining is an environmental disaster emitting high amounts of green gases enough to push the global temperature by two degrees in a decade. If such is the case, this development alone will be disastrous for fauna and flora, a catastrophe leading to the mass extinction of species.

On many occasions, research findings from an aggregate level paint Bitcoin mining as an energy-intensive activity that damages the environment because its profits encourage the use of fossil fuels. It especially illuminates the urgency of the environmental ramification caused by Bitcoin mining and its risks to climate change.

The finding questions how collected and processed data about Bitcoin (crypto) mining are interpreted. Bitcoin mining is admittedly energy-intensive because of the proof-of-work consensus algorithm for decentralization and security.

Why Bitcoin Mining Could be worse for the Environment

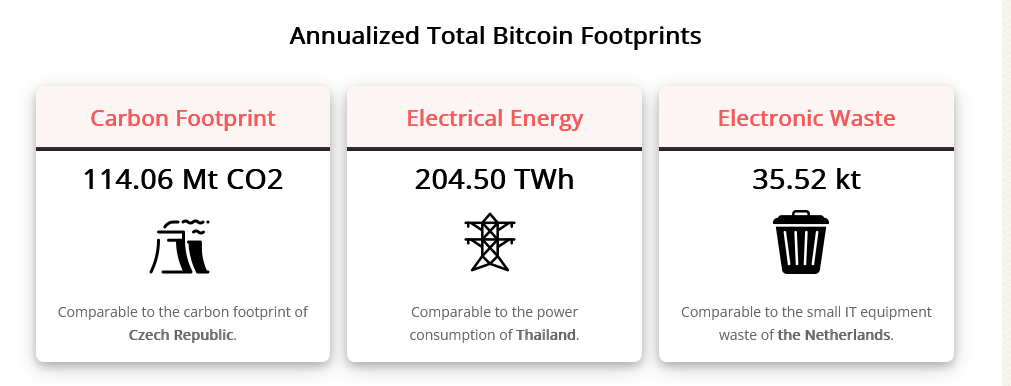

Data from the Cambridge Centre for Alternative Finance shows that the same energy needed by Thailand powers the Bitcoin network.

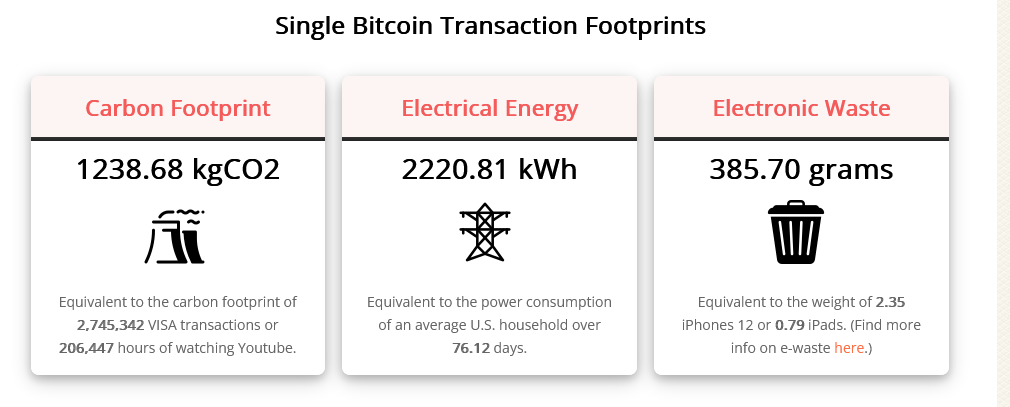

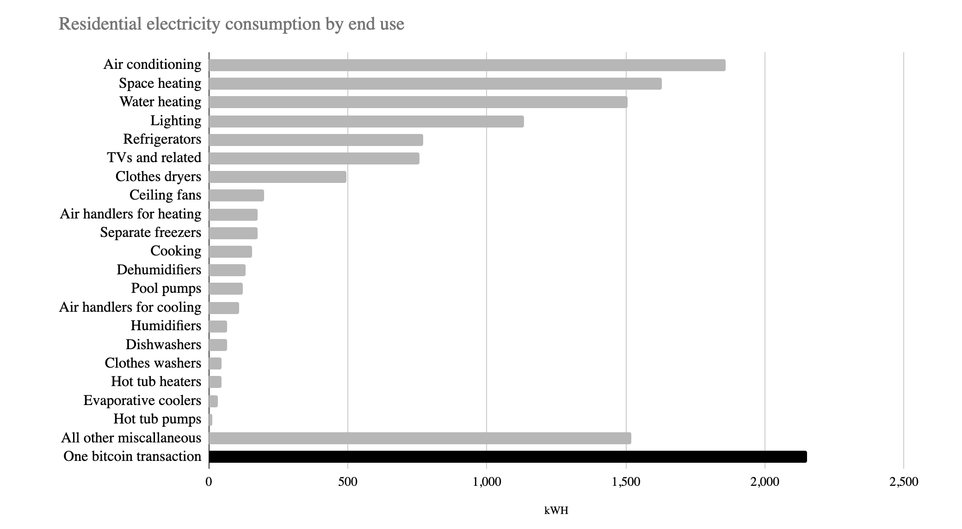

However, analyzing the network’s energy requirement from a granular level paints a damning picture of the full effect of Bitcoin mining according to an independent analysis. In a blog, Sebastian Rollen used available data to compare household energy requirements versus Bitcoin energy consumption.

He first noted that comparing Bitcoin’s energy use with countries is ineffective and “obscures the real issue”. It is only reasonable because most Americans, according to Sebastian, are poor in Geography and find it hard to locate countries. A recent study found that less than 30 percent of those surveyed couldn’t pick out Ukraine from the map before their conflict with Russia. Worse, by comparing Bitcoin’s humongous energy requirements, readers (including critics) digress from the real issue. They often tend to think of other geographical and development (economic) issues, and thus, this metric wasn’t effective as a tool for capturing the actual energy demand for Bitcoin.

Using Household Energy Consumption as a Measure

At the same time, there could be a problem if the amount of energy used by each Bitcoin transaction was a measuring parameter. Sebastian observed that most American households use more energy-efficient gadgets like LED lights instead of light bulbs. If these equipment energy ratings and, thus, consumption were factored in during calculations, it would yield huge numbers. This would be worse from an analytical standpoint because humans inherently find it hard to wrap their heads around big numbers.

Instead, a better, more practical comparison could be to look at household electricity consumption versus Bitcoin transactions in a typical American household earning an average income. Although household electricity consumption would be markedly lower than when making wholesome BTC transactions, most users, for economic reasons, can’t afford to make single BTC transactions in a single swoop.

Instead, BTC transactions would be spread out using Dollar Cost Average (DCA) strategy, for example, probably in a year, noted Sebastian. He concludes that this would demand more energy for transaction processing if that is the case. Regardless of the time of the year, every transaction would be added to a block by a Bitcoin miner who powers their rigs using valuable electricity drawn from renewable or non-renewable sources.

Bitcoin Mining Uses Too Much Power to Process Only a Handful of Transactions

On another lens, if the impact of BTC mining is analyzed from energy consumption versus its efficacy, a clearer picture may emerge. The utility of the Bitcoin and whether the technology justifies its huge energy requirement would be painted if the growth of its rigs’ energy demand is compared to the development of total energy generated within a given period.

According to publicly accessible data, global power producers added 1,753 TWh of electricity to the grid between 2019 and 2021. During this time, Bitcoin mining rigs’ energy demand rose from approximately 38 TWh to 200 TWh. At this pace, it means 10 percent of all energy generated goes to BTC mining to enable roughly 0.003 percent of the world’s population to move approximately 250k transactions every day.

In his view, this is a dismal adoption rate for a technology like Bitcoin. Their proponents maintain it would take over to be a choice network of fund remittance or even store value in times of financial crises.

Closing Thoughts

Bitcoin mining could be energy-intensive for now. However, going by statistics, most rig operators use renewable energy. At the same time, Bitcoin is still comparatively new versus legacy systems. Considering the development evolution of Bitcoin, the possibility of shifting from a proof of work system to a more energy-efficient operation cannot be discounted in the years to come.

Thus far, the advantages of Bitcoin and blockchain technology are evident, and some financial institutions use blockchain technologies in their operations. Furthermore, as Block Magnates reported, government institutions are beginning to embrace Bitcoin mining. Considering the security of Bitcoin and what its solution brings to the table, adoption will gradually increase over the years to justify the high energy consumption in the near future.

Image Source

- Crypto News BlockMagnates: Photo by AbsolutVision on Unsplash