“In a speculative market, what counts is imagination and not analysts.”

Benjamin Graham

The world probably doesn’t need one more hot take about how NFTs are an insane financial bubble so I’ll just attempt a quick recap of the numbers here and let you draw the only logical conclusion. Last year someone sold a Crypto Punk that looks like pixelated blue version of Michael Cera in Juno for 7.67 million dollars. It’s mask wearing cousin sold for 4 million dollars more ($11.75m). Those are just 2 of the 10,000 from that collection all of which represent pieces of artwork that could be described as a demonstration of intermediate competence in Microsoft Paint.

The newly minted celebrity artist, Beeple, made a couple hundred million dollars in a year selling his digital art of subjects like Facist Buzz Light Year, Giant Clone Baby buzz light year, and a Breast Feeder buzz light year.

In September 2021 the market value for a text based “crate of loot” was $28,000.

Then there are the millions of dollars worth of bored apes bought by the likes of Steph Curry, Mark Cuban, Shaq, Eminem, DJ Khaled, Jimmy Fallon, Post Malone, Logan Paul and Paris Hilton. One gold Ape in a propeller hat sold for 3.4 million dollars, but according to ape enthusiasts the pieces with laser eyes and cigarettes actually might be worth more.

A virtual real estate investor who bought **virtual** land for 4.3 million dollars last year. Pak’s became the most expensive artist ever when he sold some black and white spheres for $91.8 million dollars.

Sotheby’s, the same auction house that has sold the works of Picasso and Michael Angelo, is now the purveyor of “JPG Summer”.

We spent **41 Billion dollars** on NFTs in 2021. Thats roughly the GDP of Paraguay or the market cap of Chipotle. The global art market was ONLY worth 50 billion U.S. dollars in 2020.

This is mania, and no capitalist is immune. So I’m proposing this social experiment would anyone buy an NFT that is explicitly a guaranteed bubble?

Contents

Programmable NFTs

All of this spending is fueled by speculation about the limitless value of what blockchain technology could be. I’m more susceptible to a rampant case of techno-optimism than anyone, and the promise of Web3 is extremely compelling, but the NFT hype train never made it past selling pieces of static art. It seems we’ve missed one of the coolest aspects of NFTs as a piece of technology: They are completely programmable.

The smart contracts for all “blue chip” NFTs, from Bored Apes to Cool Cats to Doodles, are just wrappers around existing ERC721 implementations most of which simply limit the number of tokens that can be minted and give the contract owners varying degrees of control over the initial sale. The only thing it seems like we’ve actually managed to create with them is fractional ownership, but there’s no real limit to what you can program inside of an NFT.

Not only are NFTs programmable by the nature of blockchains, they are also composable. You could program an NFT smart contract to:

- Take in multiple separate existing NFTs and mint a new NFT using the combination.

- Receive cash flows or dividends from another protocol

- Reshuffle who owns which NFT within your set on some random interval

- Financially engineer an NFT that increases in value everyday or randomly crashes

Spoiler alert, we actually already built that last one. The point is the only limit on what we can program an NFT to do is our collective imagination. Which so far for the big projects feels like is the piece that is lacking.

Introducing Bombheads

We built your standard PFP NFT and tacked on a new financial mechanic that would make John Maynard Keynes proud. Everyday, the value of this NFT will either increase dramatically or become completely worthless. Much like your favorite shitcoin, you get to play in the high risk, high reward casino of crypto without the fickle whims of the invisible hand. Until it crashes, you can sell your NFT at anytime for a constantly increasing price to a guaranteed buyer. If you hold onto this time bomb forever though, one day it will explode and become virtually worthless (or whatever the greater fool is willing to pay for it).

Some Fast and Loose Financial Theory

In order to artificially engineer an economic boom bust cycle into an NFT, you have to start with a buyer. Initially I assumed this would have to be me. I would have to personally guarantee the value of the NFT by becoming a de facto buyer for anyone who wanted to sell before the crash came. Family and friends immediately began to talk me out of this terrible idea, so I looked for other avenues to achieve the same outcome.

Much like physics, finance tends to follow Newtons Third law, and it turns out you can basically financially engineer any action as long as you can deal with an equal and opposite financial reaction. In order for us to engineer the price of our NFT to shoot to the moon, we have to engineer something else in the same contract to crash and burn. Financial engineering is a zero sum game.

All of this works out rather nicely for us since we are interested in both the Jekyll and Hyde of the free market. All we have to do is stagger the capital gains and casualties, so one NFT holders crash is another diamond handed ape’s appreciation. When one NFT self destructs, its value is redistributed to the remaining NFTs.

Okay but How does it actually work?

Typically when a successful rug pull (I mean NFT project) holds a mint. Prospective NFT holders send funds to a smart contract which creates an NFT and assigns it to them as the owner on the blockchain- a process known as “minting”. The creators of the project eventually withdraw all of that crypto from the smart contract and ride off into the Web3 Sunset.

Our project follows the same process but instead of allowing us to withdraw the proceeds of the mint, all of these funds (minus 20%) are held in the contract itself for the duration of the game. Each NFT can then be sold back to the contract for a slice of this pie. The value the contract is willing to pay for your NFT (Intrinsic Value) is equal to the amount of funds in the pot divided by the number of remaining NFTs). Everyday, 25% of the remaining NFTs are randomly selected for self destruction. Once an NFT has self destructed it can no longer be sold back to the contract. So the denominator for “number of remaining NFTs” decreases which causes the value of each remaining NFT to increase.

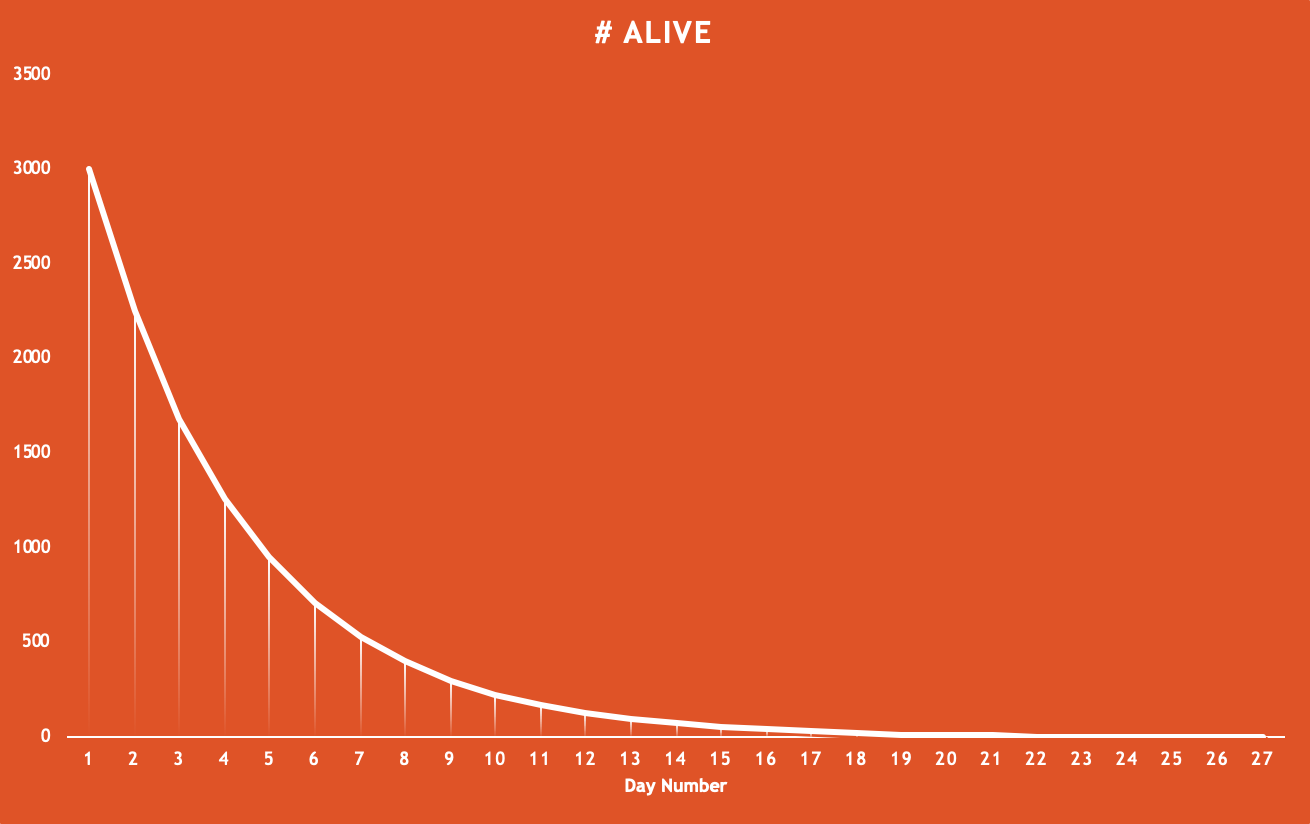

To illustrate, let’s look at a possible trajectory for the game assuming no one cashes out early. We sell 3000 Bombheads for 0.05 ETH each. After we take out 20% to keep our metaversal lights on, the contract holds 120 ETH in one big pot. At the start of the game each Bombhead can be sold back to the contract for 0.04 ETH (120 / 3000). On the first day, 750 (25% of 3000) of the bombheads self destruct, rendering them worthless, leaving 2250 bombheads remaining alive. Each remaining bombhead can now be sold back to the contract for 0.0533 ETH (120 / 2250). On day 2, another 563 bombheads (25% of 2250) will self destruct, leaving 1687 bombheads remaining each worth 0.07113 ETH (120 / 1687). This process repeats each day. On day 5, 712 Bombhead will remain each of which can be cashed in for 0.16854 ETH. On day 10, only 169 will remain alive each worth 0.71006 ETH. By the 26th day of the competition only one bombhead will remain which can be sold for the entire pot, 120 ETH.

This whole scenario will likely be affected by members who own live bombheads cashing in early, but cashing in will never lower the current intrinsic value of other remaining bombheads, only their maximum potential value in later rounds.

Originally published by Trevor Adcock originally on Block Magnates community.

Image Source

- nft blockmagnates: Photo by Tezos on Unsplash