The “Otherside NFT” land sale by the popular Bored Ape Yacht Club (BAYC) creators began on May 1, 2022.

During the highly anticipated land sale, each plot was available for purchase at 305 APE, an ERC-20 token whose price temporarily soared ahead of the auction.

Although the sale dumped the usual Dutch Auction, it had some caveats that questioned Yuga Labs’ preparedness considering retail NFT collectors’ sensitivity to Gas fees.

Dutch auctions are actually bullshit, so Otherdeeds will be sold for a flat price of 305 ApeCoin 🧵.

— OthersideMeta (@OthersideMeta) April 29, 2022

Contents

Ethereum Temporarily Knocked Off

The rush to acquire land and be part of Yuga Lab’s success was understandable. Over the past few years, BAYC NFTs have earned the creator millions of dollars in revenue—and the number keeps growing as collectors jostle for these rare and uniquely illustrated apes.

It has emerged that Yuga Labs failed to optimize its smart contracts for Gas fees causing NFT purchasers to spend over $80 million extra in fees. The congestion caused by the race to purchase land temporarily “switched off” the lights in Ethereum, even causing Etherscan to halt temporarily. This outage subsequently caused disruptions in other crypto markets.

We’re sorry for turning off the lights on Ethereum for a while. It seems abundantly clear that ApeCoin will need to migrate to its chain to scale properly. We want to encourage the DAO to start thinking in this direction.

How Yuga Labs would Have Saved Users over $80 Million in Gas Fees

Ethereum might be one of the most decentralized networks but has a scaling problem. On-chain demand often leads to congestion, leading to Gas spikes despite desperate attempts to incorporate fee-curbing techniques. The activation of EIP-1559, as evidenced by the congestion, was of little help on May 1 when fees soared to $196 to send a simple transaction.

The “Otherside NFT” land sale saw collectors spend over $200 million in Gas within the first hour of launch–but it could have been lower. Analysts have pointed out that this was because Yuga Labs didn’t optimize their contracts to reduce Gas fees.

Nearly $100M has been spent on gas for the BAYC land sale in one hour. This is money that could have gone to Yuga or stayed in user's pockets.

— Will Papper ✺ (@WillPapper) May 1, 2022

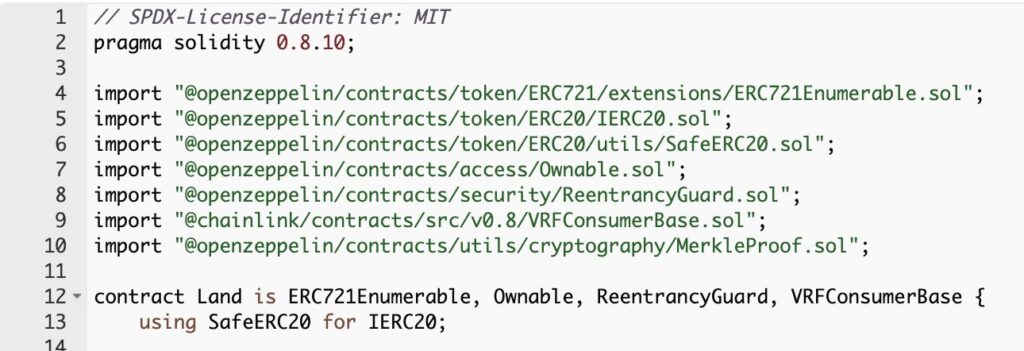

The contract had nearly zero gas optimizations. I'll explain a few gas optimization tricks that could have saved many millions below 👇 pic.twitter.com/CsYvWdEQKc

According to experts, the minter could have, for example, removed the ERC721Enumerable extension, saving land buyers around 70 percent in Gas costs.

Moreover, Yuga Labs could have used the Use ERC721A, making the minting of different NFTs of the same wallet as cheap as minting one NFT.

Image Source

- nft blockmagnates: Photo by Tezos on Unsplash