The gap between correcting Bitcoin prices, rising electricity costs, and rig maintenance requirements, according to reports, is forcing miners to liquidate their BTC reserves with increasing concerns that the network’s hash rate will suffer in the weeks to come.

Bitcoin Miners Dump their Reserves on Falling BTC Prices

It should be recalled how Bitcoin miners earned ultra-high revenue in November 2021 when prices reached an all-time high of $69k in some exchanges, including Binance. Fast forward six months later, and BTC is under significant selling pressure, trading below $25k at press time.

On-chain data from GlassNode, an on-chain analytical firm, confirms that Bitcoin miners’ revenue has plunged by over 50 percent from November 2021 peaks.

Subsequently, Bitcoin miners have resorted to unloading their BTC holdings to cater to rising operational expenses as their revenue drops due to falling prices, rising electricity, and maintenance costs. Since miners are one of the largest BTC holders, their action heaps more pressure on prices, dashing bulls’ hopes.

According to GlassNode, BTC miners had been ramping up, adding to their reserves until now.

Those who have been adding #BITCOIN to their reserves are the Miners, and they are also pushing the network's computing power to historic records.

— G a a h (@gaah_im) March 7, 2022

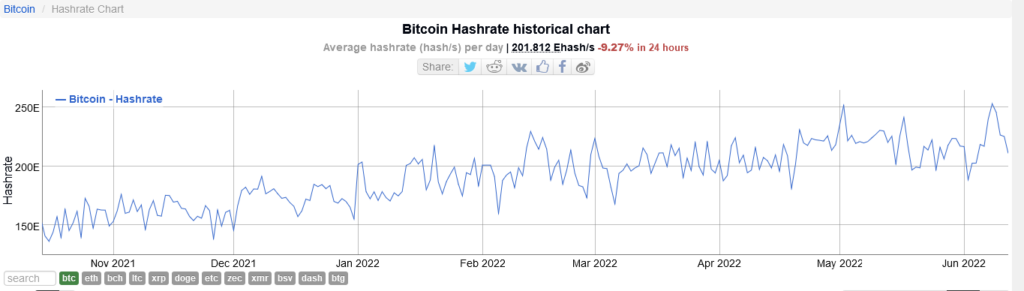

In recent weeks, the Hashrate has reached as high as 212,000 Ehash/s.

1/5🧵 pic.twitter.com/8dpThlmfMX

Following the LUNA and UST “Black Swan” event in early May, GlassNode observes that there has been a net distribution running to the tune of about 6k BTC.

According to analysts, this move is to cater to high operational expenses and cover bases considering the general bearish sentiment across the board. Sellers are apprehensive that BTC prices would likely plunge deeper into the $20k zone.

The drop in Bitcoin prices has massively impacted their revenue streams, which have more than halved from November last year.

What the Future Holds for Miners

With over 19 million BTC circulation and hash rate still at record levels, analysts say Bitcoin and crypto mining would be dicey going forward. Thus far, the Bitcoin hash rate remains high at over 200 EH/s while revenue slows due to free-falling market prices.

It would be tough for new miners to stay profitable in the weeks ahead, provided prices remain depressed. In current market conditions, most will probably switch off their rigs and wait till prices recover. With falling hash rate, the Bitcoin network would likely adjust its difficulty to reflect possible miner attrition.

Image Source

- Crypto News BlockMagnates: Photo by AbsolutVision on Unsplash