In a shocking news, Apecoin has now crashed 97% below its all time high of $39.40. The impact has also been felt in the Ape NFTs which now have seen their floor price crash to less than 12 ETH.

However, for holders who are concerned about losing value in their investments, we have two positive news too.

Contents

Situation with Apecoin

After Apecoin made a high of $5.3 in March 2024, the cryptocurrency has only moved downwards. Now as on 19th April 2024, the price is very close to $1.2 and seems to be in a downtrend.

If we take a look at the weekly charts, Apecoin is very close to a strong support. This support has already helped Apecoin twice with bounce backs from $1 in the period July-Oct.

Its all time low was at $1 on March 17, 2022.

Impact Felt on Ape NFTs Too, Floor Price Sinks to 12 ETH

The Ape NFTs too have fallen greatly. The floor price has already dropped to less than 12 ETH. The reason for the decreasing prices of both Apecoin and Ape NFTs seem to be the downturn in NFT markets since early 2024.

Another reason for the decline is because of the advent of new chains and new NFT collections such as Milady Maker and Pudgy Penguins.

What can users do?

Users have a variety of strategies at their disposal to potentially increase their holdings and leverage market trends.

Here are two approaches users might consider with Apecoin:

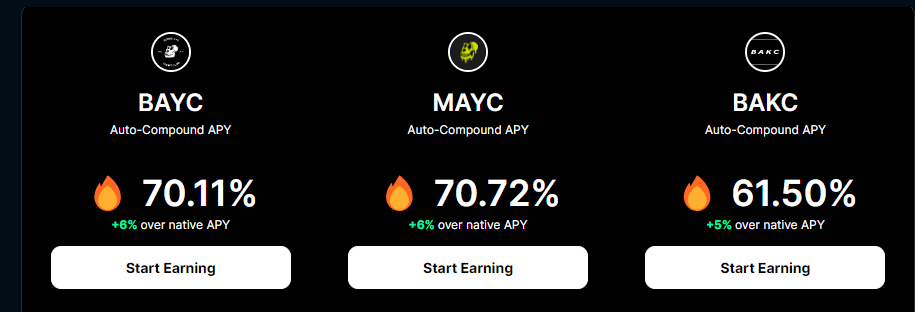

Choosing High-Yield Platforms for Staking Apecoins

Users can explore the option of staking their Apecoins on platforms that offer high yield returns.

Staking involves locking up a certain quantity of cryptocurrency to support the operation and security of a blockchain network. In return, stakers are typically rewarded with additional coins, effectively earning interest on their digital asset holdings.

By selecting platforms that provide higher yields, users can maximize their passive income potential. With more staked coins, platforms gain more security and hence are willing to pay the stakers. This is why Ethereum staking is so popular.

Users should, however, be mindful of the risks involved, including the volatility in yield rates and the potential for significant fluctuations in Apecoin’s market price.

Wait for an Upcoming Rally

Users might also consider holding onto their Apecoins in anticipation of an expected market rally.

Market analysts predict that Apecoin could rise to $3.8. This could represent a strategic opportunity for investors to realize substantial gains. The decision to hold and wait for a price increase should be based on thorough research and consideration of market trends, expert analysis, and broader economic indicators that could influence the price of Apecoin.