In the evolving landscape of global finance, Bitcoin emerges as a formidable contender to gold, the traditional bastion of value. With projections indicating Bitcoin’s potential to surpass gold’s market value between 2025 and 2027, this report delves into the pivotal factors, market dynamics, and technological advancements underpinning this shift.

We explore the historical significance of gold, Bitcoin’s trajectory, and the implications of its possible ascendance as the new standard of wealth storage.

Contents

- 1. Introduction: The Age-Old Value of Gold

- 2. Bitcoin’s Ascendancy: A Digital Revolution

- 3. The Halving Catalyst: Bitcoin’s Built-in Scarcity

- 4. Comparative Analysis: Bitcoin and Gold

- 5. Factors Driving Bitcoin’s Growth

- 6. The Future Outlook: Gold’s Resilience vs. Bitcoin’s Potential

- 7. Strategic Implications for Investors

- 8. Conclusion: The Evolving Landscape of Value

- Recommendations:

1. Introduction: The Age-Old Value of Gold

Gold has universally been the epitome of value, a symbol of wealth and a hedge against economic volatility. Its tangible nature, finite supply, and historical lineage have solidified its status as the enduring standard of wealth. However, the digital age introduces a challenger—Bitcoin, whose intangible, innovative nature represents a new era of investment.

2. Bitcoin’s Ascendancy: A Digital Revolution

Introduced in 2009, Bitcoin marked the inception of a new digital currency era, characterized by decentralization, cryptographic security, and peer-to-peer technology. Its journey from an obscure digital token to a major financial asset highlights a radical shift in how value is perceived and stored.

3. The Halving Catalyst: Bitcoin’s Built-in Scarcity

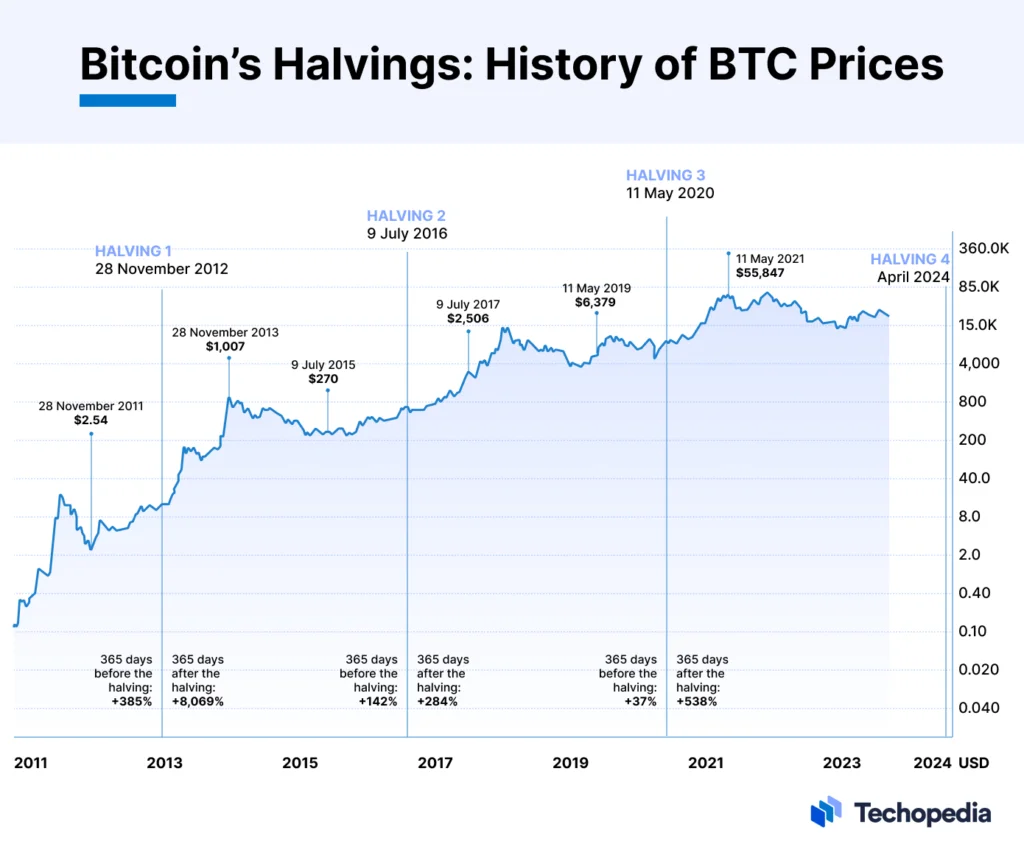

Bitcoin’s protocol includes a halving event approximately every four years, reducing the new supply of bitcoins by half. This mechanism mimics the scarcity and extraction difficulty of gold, potentially enhancing Bitcoin’s value as its supply tightens over time.

Das Crypto highlights a report by Rekt Capital in which Bitcoin shows this bull rally around each halving cycle. It mirrors its previous price rallies and is expected to do the same in 2024.

4. Comparative Analysis: Bitcoin and Gold

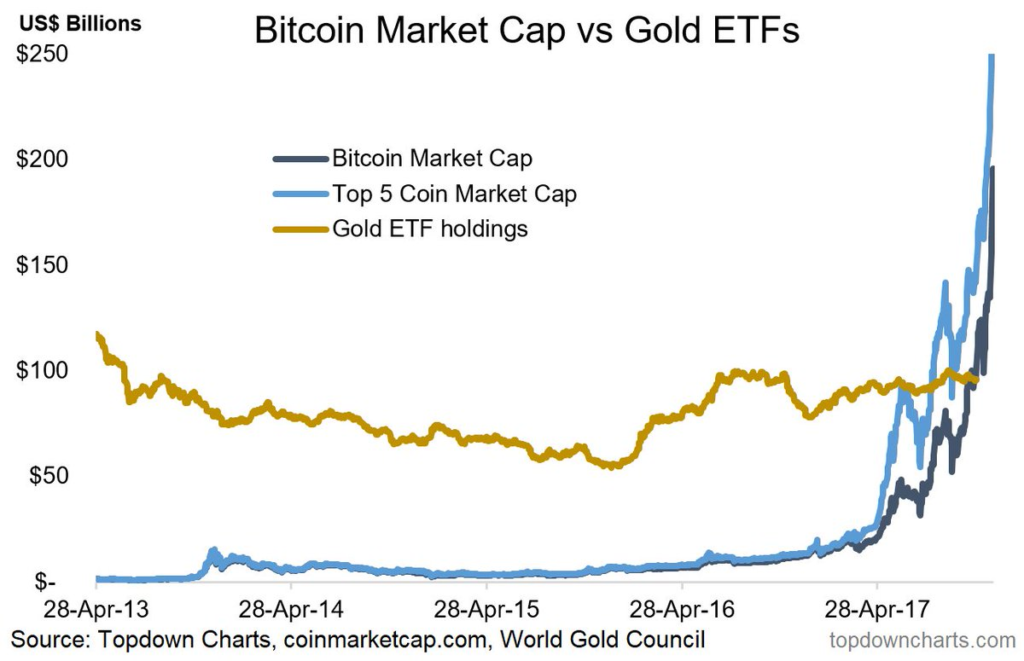

- Market Value: Current trends and analyses project that Bitcoin could reach or exceed a $1 million valuation per coin by 2025, challenging gold’s market capitalization.

- Investment Vehicle: Bitcoin ETFs and other financial products have broadened Bitcoin’s appeal to institutional and retail investors, mirroring gold’s investment pathways but with a digital edge.

5. Factors Driving Bitcoin’s Growth

- Technological Adoption: The integration of blockchain technology and the endorsement of cryptocurrencies by major corporations and governments fuel Bitcoin’s legitimacy and utility.

- Bitcoin ETF: ETFs have added a ton of value in Bitcoin. The total buying through Bitcoin ETFs within 2 months have been around 26 Billion as of March 3, 2024.

- Market Dynamics: Increasing awareness, burgeoning crypto infrastructure, and the burgeoning narrative of Bitcoin as “digital gold” contribute to its market growth.

- Innovative Utility: Developments like Bitcoin Ordinals and blockchain-based applications enhance Bitcoin’s functionality beyond a mere store of value.

6. The Future Outlook: Gold’s Resilience vs. Bitcoin’s Potential

While gold continues to be a safe-haven asset, Bitcoin’s potential to match or exceed gold’s market value hinges on its widespread acceptance, technological advancements, and its ability to maintain its narrative as a digital store of value amidst regulatory and market challenges.

7. Strategic Implications for Investors

Investors must navigate this shift with a balanced perspective, recognizing the historical stability of gold and the innovative potential of Bitcoin. Diversification, informed decision-making, and staying abreast of regulatory developments are key to leveraging the opportunities presented by both assets.

8. Conclusion: The Evolving Landscape of Value

As we approach the pivotal years of 2025-2027, the financial landscape braces for a potential redefinition of value storage. Bitcoin’s challenge to gold’s supremacy is not just a testament to its own growth but a reflection of a broader transition towards digitalization in the financial world.

Recommendations:

- Continuous Monitoring: Investors should continuously monitor the evolving regulatory, technological, and market landscapes of both Bitcoin and gold.

- Diversification: Embrace diversification, considering both traditional and digital assets to hedge against market volatility and capitalize on emerging opportunities.

- Education and Research: Stay informed through continual education and research to understand the implications of new developments in the cryptocurrency and gold markets.